From Hindubusiness line 26-Dec-2006.

`2007 will be year of consolidation and rise for the Indian markets'

Bangalore , Dec. 25

"Market is always right. Markets cannot be taught, they have to be learnt.

"We must have an attitude where we must balance fear and greed," was the hot tip by Mr Rakesh Jhunjhunwala, India's high-profile investor and President of Rare Enterprises, when he spoke at a seminar on `Wealth creation through equity investments' organised by Welingkar Institute of Management here on Friday.

Mr Jhunjhunwala spoke about his convictions that made a case for sustaining the India growth story.

Equities, because of their efficiency in allocating capital and ability to leverage, generated superior returns when compared to other assets over the long term, he said.

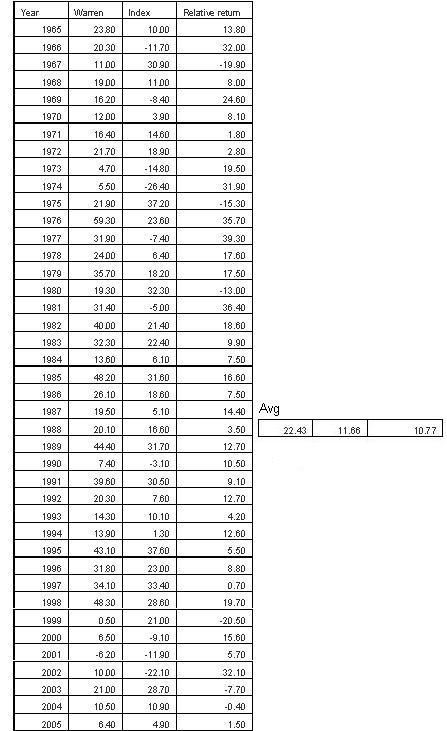

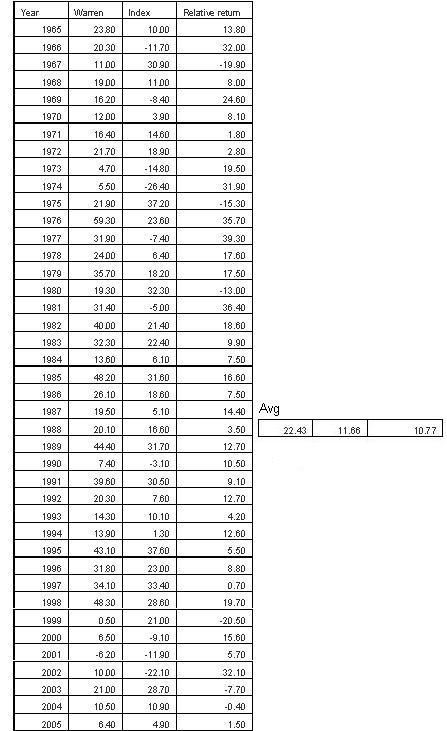

Since 1979, the Sensex has delivered 21 per cent returns compounded annual growth rate, which compares well with returns on funds managed by the legendary global investor Warren Buffet, he added.

Opportunities

Mr Jhunjhunwala said that enormous wealth was created over the last five years because opportunities in India have been manifold.

There is a strong case for investing in equities considering its under-penetration today.

He predicts the proportion of household savings to equity to rise to 15 per cent in 2011 from 4.5 per cent now as a result of which about $45 billion would flow into equity markets as against $6 billion now.

He expects 2007 to be a year of consolidation and rise for the Indian markets. According to him, the Sensex may have a floor at 12,500 and a peak at 16,500 in 2007.

Admitting that gains were going to be moderate in future unlike the manifold rise over the last few years, he advised investors to be realistic in their expectations.

He said that markets were unlikely to peak unless they were trading at a multiple of 25-30 times forward earnings. They are currently trading at about 16 times their earnings for financial year 2008.

Growth momentum

Speaking on the strength in India's fundamentals, he elaborated on forces that would sustain the growth momentum.

According to him, growth enablers (such as favourable demographics, higher base of skilled people and education base), liberalisation catalysts (such as competition), fall in interest rates, multiplier effect (on account of reforms), structural changes in quality of corporate earnings and micro trends (such as change in mindset of companies who are aspiring to become global) are likely to drive India's growth story to a higher level.

He, however, cautioned that investors should not forget the four-letter word `Risk' while making investment decisions.

"Patience may be tested, but conviction will be rewarded," he said. Mr K. Rajagopal, CIO, Reliance Capital Asset Management, and Mr Joseph Massey, Deputy Managing Director, MCX, were among other speakers on the occasion.

Tuesday, December 26, 2006

Tuesday, December 19, 2006

Best stock market analyst

- Kuppusamy Chellamuthu

Posting some of the mail discussions from 'india_next' yahoo group.

First:

I have been trading in stocks for the last three years and losing money (yearly 2.5 lakhs on an average). I have tried everything from trading on my own intuition to getting tips from experts. There havent been a single three months streak where I have made money. Now what should I do? Do somebody have any idea who is the best analyst in India so that using his tips we can also make money? I dont care if he is a technical analyst or a fundamental analyst. I am ready to daytrade, invest or scalp. Who is the best out there? Please send me a mail if somebody has an opinion. Please do not mix business with this and do not send business advertisements.

Second:

I have a seasoned investor friend who often says, "Trading is one of the most sophisticated suicidal methods".

When you do day-trading your odds of gaining and losing are evenly poised, leaving apart the money you have to make up for brokerage and taxes. When a person comes with an intention of trading, his chance of winning is 0.50 (50%). He can either go broke or get the money enabling him to go ahead to the next day. His chance of gaining on the end of second day is 0.50 (for the previous day) X 0.50 (for second day) = 0.25. His chance of winning is reduced to 25% and to 12.5% on the third day. This has been proven by history. People who go great money in stocks were not addicted traders.

You did not need to beat the index by a substantial margin. But, had you stayed invested in sensex companies, your money would have grown decently during the past 3 years, which has been the best time for Indian stock market. Unless you are a broker, you don't need to advocate trading.

And...As our motive in operating stock market is to make money, seeking day-trading tips is nothing but a quick solution to the question 'how to make money in a day?' I am completely convinced that any person who has an answer for this question won't need to make money by selling his 'tips'.

Aa such, I don't detest trading. But, want to be sure on what I am trading. Otherwise better prefer flying to Los Vegas to try my luck.

Regret if your question did not get answer. I also believe that no other member of this group am not knows any such 'tipsters' who can facilitate us make money.

And finally, you are lucky enough to learn things at the expense of three years and 2.5 lakhs. There are people who paid much more for some trivial lessons.

Posting some of the mail discussions from 'india_next' yahoo group.

First:

I have been trading in stocks for the last three years and losing money (yearly 2.5 lakhs on an average). I have tried everything from trading on my own intuition to getting tips from experts. There havent been a single three months streak where I have made money. Now what should I do? Do somebody have any idea who is the best analyst in India so that using his tips we can also make money? I dont care if he is a technical analyst or a fundamental analyst. I am ready to daytrade, invest or scalp. Who is the best out there? Please send me a mail if somebody has an opinion. Please do not mix business with this and do not send business advertisements.

Second:

I have a seasoned investor friend who often says, "Trading is one of the most sophisticated suicidal methods".

When you do day-trading your odds of gaining and losing are evenly poised, leaving apart the money you have to make up for brokerage and taxes. When a person comes with an intention of trading, his chance of winning is 0.50 (50%). He can either go broke or get the money enabling him to go ahead to the next day. His chance of gaining on the end of second day is 0.50 (for the previous day) X 0.50 (for second day) = 0.25. His chance of winning is reduced to 25% and to 12.5% on the third day. This has been proven by history. People who go great money in stocks were not addicted traders.

You did not need to beat the index by a substantial margin. But, had you stayed invested in sensex companies, your money would have grown decently during the past 3 years, which has been the best time for Indian stock market. Unless you are a broker, you don't need to advocate trading.

And...As our motive in operating stock market is to make money, seeking day-trading tips is nothing but a quick solution to the question 'how to make money in a day?' I am completely convinced that any person who has an answer for this question won't need to make money by selling his 'tips'.

Aa such, I don't detest trading. But, want to be sure on what I am trading. Otherwise better prefer flying to Los Vegas to try my luck.

Regret if your question did not get answer. I also believe that no other member of this group am not knows any such 'tipsters' who can facilitate us make money.

And finally, you are lucky enough to learn things at the expense of three years and 2.5 lakhs. There are people who paid much more for some trivial lessons.

Friday, August 11, 2006

Interview of a Sri Lankan industrialist

This is an interview of a businessman in Sri Lanka that featured in today’s (11-Aug-06) Business Line daily.

It is interesting to see how this businessmen of this island nation look at India how our outsourcing sector looks at United States. Even among conflicts they are growing at a healthy rate. One should not be surprised to if service sector job slowly move from India to low cost countries like Sri Lanka. May be we should also encourage building up huge tourism industry.

Leaving other matters in the discussion apart, I always wonder why both politicians and businessmen of this island tried to constantly persuade Indian government not to go ahead with Sedhu project.

It is interesting to see how this businessmen of this island nation look at India how our outsourcing sector looks at United States. Even among conflicts they are growing at a healthy rate. One should not be surprised to if service sector job slowly move from India to low cost countries like Sri Lanka. May be we should also encourage building up huge tourism industry.

Leaving other matters in the discussion apart, I always wonder why both politicians and businessmen of this island tried to constantly persuade Indian government not to go ahead with Sedhu project.

Thursday, July 27, 2006

GMR IPO..

- by Kuppusamy Chellamuthu

No activity off late in this as it was in the market for retail investors.

Drying volumes, beaten down prices, no cash to buy… none of them was surprise & new. Most hit was the primary market where quite a few companies pulled back their IPO plans and rest that dared got poor response.

Past few days sentiments apparently getting back. However every adverse reason that prevailed a month back still remains intact despite the fact that some of quality stock s available at comfortable valuation. I would love to see the market at the same levels or even further slide. That would give me a long stretch of consolidation period with few more paydays ahead. If buying stock at cheap valuation is the motto of investing, we have every reason to rejoice bear domination. But a bear can last anywhere between a minute to couple of centuries. DJIA was at the same levels in 1964 & 1981, 17 long years. Japanese index fell all the way from 30 thousands points to 4 digits.

You rarely know whether your date is expensive or not. A fancy girl can make a fatty credit-card bill for you to pay for months. As a matter of fact, it is rarer to predict the markets than a fancy girl.

Infrastructure major GMR ventures to tap the primary market, though with a reduced price band. It is learnt that George Soros' Quantum fund and ICICI ventures have taken sizable stake at the price higher than the propose price band. That does not assure anything at the outset for an investor. If this issue gets good response especially from retail segment, it might probably revive primary market sentiment. That should be a good news because that is the only money injected into companies' balance sheet and projects, indirectly fuelling economy. Secondary Markey irrespective of its rise & fall does not have direct influence on economy, except causing fluctuating income for brokers and traders.

GMR is the major stake holder in Hyderabad international airport and modernizing Delhi airport. Interestingly it own hundreds of acres of land around these 2 airports. Company is also into other infrastructure and power generation activities. That makes one interesting. However looking at Fy-2006 earnings its IPO price is at mammoth valuation of around 90 times. Leave the bal to the keeper & wait???

No activity off late in this as it was in the market for retail investors.

Drying volumes, beaten down prices, no cash to buy… none of them was surprise & new. Most hit was the primary market where quite a few companies pulled back their IPO plans and rest that dared got poor response.

Past few days sentiments apparently getting back. However every adverse reason that prevailed a month back still remains intact despite the fact that some of quality stock s available at comfortable valuation. I would love to see the market at the same levels or even further slide. That would give me a long stretch of consolidation period with few more paydays ahead. If buying stock at cheap valuation is the motto of investing, we have every reason to rejoice bear domination. But a bear can last anywhere between a minute to couple of centuries. DJIA was at the same levels in 1964 & 1981, 17 long years. Japanese index fell all the way from 30 thousands points to 4 digits.

You rarely know whether your date is expensive or not. A fancy girl can make a fatty credit-card bill for you to pay for months. As a matter of fact, it is rarer to predict the markets than a fancy girl.

Infrastructure major GMR ventures to tap the primary market, though with a reduced price band. It is learnt that George Soros' Quantum fund and ICICI ventures have taken sizable stake at the price higher than the propose price band. That does not assure anything at the outset for an investor. If this issue gets good response especially from retail segment, it might probably revive primary market sentiment. That should be a good news because that is the only money injected into companies' balance sheet and projects, indirectly fuelling economy. Secondary Markey irrespective of its rise & fall does not have direct influence on economy, except causing fluctuating income for brokers and traders.

GMR is the major stake holder in Hyderabad international airport and modernizing Delhi airport. Interestingly it own hundreds of acres of land around these 2 airports. Company is also into other infrastructure and power generation activities. That makes one interesting. However looking at Fy-2006 earnings its IPO price is at mammoth valuation of around 90 times. Leave the bal to the keeper & wait???

Thursday, July 06, 2006

Tata steel questions

People might have heard of events happening around Tata steel camp.

Promoter’s holding company Tata sons has decided to increase its stake in Tata steel through preferential allotment and warrants route. Though we understand it is intended to shun any potential hostile bid by steel baron Mittal, what I fail to understand are……

1. If injecting further money into the business was the motive, why can’t they go with all out preferential issue rather than some amount of warrants?

2. I hope warrants are another form of options (like ESOP for executives) where in promoter does not need to shell out money immediately, but with a premium (like a call or put option) at the time of Warrant issue. Given these assumptions being true, what would probably be the exercise price as pronounced by ‘SEBI prescribed price formula’?

3. This question is not directly related to Tata steel, but with games played around convertible warrants. Does any one have a clue on what the price determination formula that SEBI prescribes for an unlisted company is? Has anyone closely followed DLF case where minority shareholder was apparently betrayed by the greedy promoter? Are there any similarities between DLF and Tata steel warrants? If the real motive is to raise money, why can’t Mr.Ratan Tata provide warrants for every Tata steel shareholder instead of Tata sons?

The news item (from Hindu business line) is below for reference.

----------------------------------------

Separately, Tata Steel informed the BSE that it would issue on preferential basis 2.70 crore ordinary shares of Rs 10 each at a price of Rs 516 per share for Rs 1,393.2 crore to Tata Sons.

Also proposed were 2.85 crore warrants, each entitling Tata Sons to subscribe to one ordinary share of Tata Steel against cash payment. The promoter company would pay Rs 51.60 per warrant on allotment; Tata Sons can exercise its option after April 1, 2007but not later than 18 months from the date of issue, in accordance with SEBI prescribed pricing formula.

"You may ask why this injection of funds (Rs 6,500 crore ) is not being made as a rights issue to shareholders. The main reason for that is - through an overseas issue we can perhaps obtain prices that are close to market prices today, which, we would not be able to do in the case of shareholders who would justifiably want a discount, and a substantial discount from market value. This we will consider in time as we always have. But if we want to hold dilution to a minimum and protect existing shareholders, we expect to raise these funds in a manner that it will not exceed 15 per cent of the prevailing paid-up capital of the company.

Promoter’s holding company Tata sons has decided to increase its stake in Tata steel through preferential allotment and warrants route. Though we understand it is intended to shun any potential hostile bid by steel baron Mittal, what I fail to understand are……

1. If injecting further money into the business was the motive, why can’t they go with all out preferential issue rather than some amount of warrants?

2. I hope warrants are another form of options (like ESOP for executives) where in promoter does not need to shell out money immediately, but with a premium (like a call or put option) at the time of Warrant issue. Given these assumptions being true, what would probably be the exercise price as pronounced by ‘SEBI prescribed price formula’?

3. This question is not directly related to Tata steel, but with games played around convertible warrants. Does any one have a clue on what the price determination formula that SEBI prescribes for an unlisted company is? Has anyone closely followed DLF case where minority shareholder was apparently betrayed by the greedy promoter? Are there any similarities between DLF and Tata steel warrants? If the real motive is to raise money, why can’t Mr.Ratan Tata provide warrants for every Tata steel shareholder instead of Tata sons?

The news item (from Hindu business line) is below for reference.

----------------------------------------

Separately, Tata Steel informed the BSE that it would issue on preferential basis 2.70 crore ordinary shares of Rs 10 each at a price of Rs 516 per share for Rs 1,393.2 crore to Tata Sons.

Also proposed were 2.85 crore warrants, each entitling Tata Sons to subscribe to one ordinary share of Tata Steel against cash payment. The promoter company would pay Rs 51.60 per warrant on allotment; Tata Sons can exercise its option after April 1, 2007but not later than 18 months from the date of issue, in accordance with SEBI prescribed pricing formula.

"You may ask why this injection of funds (Rs 6,500 crore ) is not being made as a rights issue to shareholders. The main reason for that is - through an overseas issue we can perhaps obtain prices that are close to market prices today, which, we would not be able to do in the case of shareholders who would justifiably want a discount, and a substantial discount from market value. This we will consider in time as we always have. But if we want to hold dilution to a minimum and protect existing shareholders, we expect to raise these funds in a manner that it will not exceed 15 per cent of the prevailing paid-up capital of the company.

Wednesday, June 21, 2006

Two IPOs withdrawn..

Two companies Bluplast Industries and Vigneshwara Exports have decided to withdraw their IPO due to poor response. This was done as a result of mere 89% subscription even after price band was brought down to Rs 110-124 from Rs 121-140 range in case of Vigneshwara Exports .

Look at the news...

Look at the news...

Tuesday, June 13, 2006

Market at 7,000 points?

- by Kuppusamy Chellamuthu

Investment guru Mark Faber some time back had observed that a 30% fall in the price of Indian equities was very much in the offering. Now he has advised investors to take holiday till October and relax. We have neither the experience nor the exposure to comment on his observation.

However what we can figure out is whether a 30% down is possible? What was believed to be a cynical view a month back, this now is a reality. BSE index had come down from as high as 12650 to 9100 levels, close to 30% in absolute terms. Do we expect some more downside movement? Well.. only an astrologer can tell.

Imagine a stock trading at 25 times of its TTM earning with anticipation of prosperous growth. Due to macro economic conditions and company’s performance, market can pretty much re-rate it 17 times levels. This is 32%.. when this particular stock, sector, country, equity as an asset class turn unfavorable for investors globally, even further loss is not ruled out.

After the market shrunk to 9500 levels, many experts came out openly saying that the real value of Sensex was around 7000 levels. Before commenting on their views, we have to see what happened to individual portfolios of small investors. Only a tiny percentage of long term investors managed to restrain their loss (even unrealized) within 30%. In many cases, the fall has been anywhere between 40% to 60%. A close analysis of most of the stocks would have revealed another fact. They now trade around the prices when sensex was around 6500. So.. in real sense, the impact of this crash is much more than what the index shows. Is Sensex not a true indicator of the entire market. Well.. the argument continues.

Now, we need to pay attention to these experts who claimed the true value being around 7000 levels. Did any one of these experts dare to pronounce this 6 weeks back? Accordingly these same people, the market was predicted to cross 15,000 before we cross 2006. Indian economy was strong and corporate performance was robust too. In just one month, concerns of inflation, government deficit and immaturity of our capital market are attributed now. Most of the times, it is hard to understand these statements, at least for me.

Investment guru Mark Faber some time back had observed that a 30% fall in the price of Indian equities was very much in the offering. Now he has advised investors to take holiday till October and relax. We have neither the experience nor the exposure to comment on his observation.

However what we can figure out is whether a 30% down is possible? What was believed to be a cynical view a month back, this now is a reality. BSE index had come down from as high as 12650 to 9100 levels, close to 30% in absolute terms. Do we expect some more downside movement? Well.. only an astrologer can tell.

Imagine a stock trading at 25 times of its TTM earning with anticipation of prosperous growth. Due to macro economic conditions and company’s performance, market can pretty much re-rate it 17 times levels. This is 32%.. when this particular stock, sector, country, equity as an asset class turn unfavorable for investors globally, even further loss is not ruled out.

After the market shrunk to 9500 levels, many experts came out openly saying that the real value of Sensex was around 7000 levels. Before commenting on their views, we have to see what happened to individual portfolios of small investors. Only a tiny percentage of long term investors managed to restrain their loss (even unrealized) within 30%. In many cases, the fall has been anywhere between 40% to 60%. A close analysis of most of the stocks would have revealed another fact. They now trade around the prices when sensex was around 6500. So.. in real sense, the impact of this crash is much more than what the index shows. Is Sensex not a true indicator of the entire market. Well.. the argument continues.

Now, we need to pay attention to these experts who claimed the true value being around 7000 levels. Did any one of these experts dare to pronounce this 6 weeks back? Accordingly these same people, the market was predicted to cross 15,000 before we cross 2006. Indian economy was strong and corporate performance was robust too. In just one month, concerns of inflation, government deficit and immaturity of our capital market are attributed now. Most of the times, it is hard to understand these statements, at least for me.

Saturday, May 27, 2006

Valuing a business - net present value

- Kuppusamy Chellamuthu

One of the most important and basic requirement for anyone aspiring to venture into the financial world is ‘money value’. Money in many ways is to be treated on par with time. Both of them are to be wisely spent. Knowing the value of money yesterday, today and tomorrow is essential.

One generally held belief in the capital market is that the share price of a firm represents sum of present value of all the money to be earned (or liquated) by it’s operations from today till infinity. This statement could not be easily appreciated by anyone who does not know the present value of future money.

Present value:

Rs.100 next year is not equal to the same amount available today. When adjusted for 5% inflation, next year’s Rs.100 would be worth Rs.95 now. Cash flows of Rs100 each for five years in the future does not really equal to Rs. 500 at present.

If some one borrows some money from you now with a promise or returning back Rs.100 five years later, the money you are likely to lend him is Rs.77.38 & not Rs.100.

Given this backdrop of present value concept, let us now see what could be the present value of a taxi business. Mr.X runs a cab which is likely to earn the following amount of money after paying for driver, police (??) and tax departments. At the end of 3 years, the taxi becomes non-operational and it’s salvage value would be Rs.1.5 lakhs.

End of year 1:

Earnings from operation = Rs.60,000

Equivalent Present value = Rs.57,000

End of year 2:

Earnings from operation = Rs.50,000

Equivalent Present value = Rs.45,125

End of year 3:

Earnings from operation = Rs.60,000

Total money including salvage value = Rs. 2,10,000

Equivalent Present value = Rs 1,80.048.80

Total net present value of all future money = 57,000 + 45,125 + 1,80.048.80 = Rs.2,82,173.8

Given the expected earnings from operations are intact, it is not prudent in paying more than Rs2.8 lakhs for this business. This applies to any investment be it in shares, research, education, bank deposits, lending money or even delaying you dowry.

One of the most important and basic requirement for anyone aspiring to venture into the financial world is ‘money value’. Money in many ways is to be treated on par with time. Both of them are to be wisely spent. Knowing the value of money yesterday, today and tomorrow is essential.

One generally held belief in the capital market is that the share price of a firm represents sum of present value of all the money to be earned (or liquated) by it’s operations from today till infinity. This statement could not be easily appreciated by anyone who does not know the present value of future money.

Present value:

Rs.100 next year is not equal to the same amount available today. When adjusted for 5% inflation, next year’s Rs.100 would be worth Rs.95 now. Cash flows of Rs100 each for five years in the future does not really equal to Rs. 500 at present.

If some one borrows some money from you now with a promise or returning back Rs.100 five years later, the money you are likely to lend him is Rs.77.38 & not Rs.100.

Given this backdrop of present value concept, let us now see what could be the present value of a taxi business. Mr.X runs a cab which is likely to earn the following amount of money after paying for driver, police (??) and tax departments. At the end of 3 years, the taxi becomes non-operational and it’s salvage value would be Rs.1.5 lakhs.

End of year 1:

Earnings from operation = Rs.60,000

Equivalent Present value = Rs.57,000

End of year 2:

Earnings from operation = Rs.50,000

Equivalent Present value = Rs.45,125

End of year 3:

Earnings from operation = Rs.60,000

Total money including salvage value = Rs. 2,10,000

Equivalent Present value = Rs 1,80.048.80

Total net present value of all future money = 57,000 + 45,125 + 1,80.048.80 = Rs.2,82,173.8

Given the expected earnings from operations are intact, it is not prudent in paying more than Rs2.8 lakhs for this business. This applies to any investment be it in shares, research, education, bank deposits, lending money or even delaying you dowry.

Monday, May 22, 2006

Attitude on market crash

Kuppusamy Chellamuthu

There was a cartoon in the Sunday edition of Hindu Business Line. An investment advisor is seen with band-aids on his fractured forearm rapped around the neck. And he says, "Yes..the same guy who sent me sweets when the Sensex first reached 10,000, did this now"

How true? When the market reached 10,000 points fro 9,000 points we all were delighted. It is hardly 3 months from then and the situation is no bad than it was then. What is the reason to feel sad?

Some people bought at low levels and hence afford to appreciate the above logic. But what about folks got in at higher levels? 12,000 and above.. what the **** is the problem? You buy a house for Rs.10 lakhs as you are fully convinced that it is worth that money. Some days later somebody offers you 9 lakhs to buy the house from you. He also sells a similar house he owns for 9 lakhs to another guy. In fact he is also ready to sell another such house to you as well for 9laks. Is it not good?

How does that affect you? Some one else selling his property should not affect you as you bought it for what you thought it deserves. Right? Then why worry??

Indeed it should make you happy. I tell you why.. you buy a business for value X and the same business is available at 0.75X with in days. There is absolutely nothing to worry. May be the ones buying now get it much cheaper than what you paid. But you certainly did not pay much if your decision was not influenced by the market condition and performance of others.

While it is true that this is hard to digest as emotion and money are involved here in great deal. But still we all learn from mistakes, sometimes our own and sometimes from that of others. Learning is not learning until it helps avoiding the same mistake again.

If you had bought with though of selling your positions off at a higher level (say 13 k or 15k), then by definition you are not an investor. No one would say, "I invested in a house for 10 lakh and would sell it for 15 lakhs after a week". He is trading/manipulating/speculating and for god sake not investing. If that is the intention people buy stocks with, yes.. this mail might seem another bluff....

This group has some successful derivative trader and I am not really sure how far it would be appreciated by them. I can afford to talk philosophy even in pain. When compared to the deep declines in January and April 2005, I am doing better with October 2005 and May 22, 2006 declines. Wait until a good ball is bowled. Mr.Market sees nothing but negative things for the investment and real world these times.

There was a cartoon in the Sunday edition of Hindu Business Line. An investment advisor is seen with band-aids on his fractured forearm rapped around the neck. And he says, "Yes..the same guy who sent me sweets when the Sensex first reached 10,000, did this now"

How true? When the market reached 10,000 points fro 9,000 points we all were delighted. It is hardly 3 months from then and the situation is no bad than it was then. What is the reason to feel sad?

Some people bought at low levels and hence afford to appreciate the above logic. But what about folks got in at higher levels? 12,000 and above.. what the **** is the problem? You buy a house for Rs.10 lakhs as you are fully convinced that it is worth that money. Some days later somebody offers you 9 lakhs to buy the house from you. He also sells a similar house he owns for 9 lakhs to another guy. In fact he is also ready to sell another such house to you as well for 9laks. Is it not good?

How does that affect you? Some one else selling his property should not affect you as you bought it for what you thought it deserves. Right? Then why worry??

Indeed it should make you happy. I tell you why.. you buy a business for value X and the same business is available at 0.75X with in days. There is absolutely nothing to worry. May be the ones buying now get it much cheaper than what you paid. But you certainly did not pay much if your decision was not influenced by the market condition and performance of others.

While it is true that this is hard to digest as emotion and money are involved here in great deal. But still we all learn from mistakes, sometimes our own and sometimes from that of others. Learning is not learning until it helps avoiding the same mistake again.

If you had bought with though of selling your positions off at a higher level (say 13 k or 15k), then by definition you are not an investor. No one would say, "I invested in a house for 10 lakh and would sell it for 15 lakhs after a week". He is trading/manipulating/speculating and for god sake not investing. If that is the intention people buy stocks with, yes.. this mail might seem another bluff....

This group has some successful derivative trader and I am not really sure how far it would be appreciated by them. I can afford to talk philosophy even in pain. When compared to the deep declines in January and April 2005, I am doing better with October 2005 and May 22, 2006 declines. Wait until a good ball is bowled. Mr.Market sees nothing but negative things for the investment and real world these times.

Rahul Dravid style of investing

Kuppusamy Chellamuthu

Rahul Dravid, the captain of Indian cricket team is a dream hero, not just for some pretty girls. He is a hero for various people ranging from observers, fans, aspiring young player, team mates etc.. When we partied at a friend’s home, there was an opportunity to meet a person who is a bank employee. He remembered his days when he played together with Rahul for India cements.

“Dravid is still the same. He won’t engage in any kind of rubbish talks especially on matters involving other players on matters other than cricket. Pretty confined and composed person he was with focus on the game every minute. His dedication stood him out among others. I am confident these are the qualities that took him this high in his career”

How true? I was exhilarated hearing this banking officer talk about the captain.

Note: I have allocated one full chapter Rahul Dravid investment style in my stock market book 'The Science of Stock Market Investment - Practical Guide to Intelligent Investors'

In him, we can not see the kind of aggression, excitement, attack seen with Sehwag and Dhoni. Does that mean that he is no important that the rest? Certainly not. As a matter of fact, Dravid is the key player and stands out to be a pillar of the team. He is very very successful player for ages with his consistency & perseverance. His strength is to tire the bowlers till they get weak while keeping him at the same sound position.

Benjamin Graham presented a simple investment plan with the help of baseball game. As I could not understand the game of baseball to the extend the investing game was understood and also our immense proximity to cricket, I developed a conviction that the same plan could be based on Dravid’s style of batting. As investors we have a lot to lean from Dravid.

Unlike test cricket, the game of investing is played for life time. Every stock quote is like a delivery bowled outside the off stump. Unless we go & hit the ball, the ball does not warrant us to hit it.

When the bowler gets tired or when an out of form bowler comes in to attack, you can expect loose deliveries. These are the times for which Rahul conserves his energy for. A 4 or 6 is in the offering. Here we have an edge over Dravid in the sense that he can only get a maximum of 6 runs in a ball. But in the market we can even go for & hit with crores & crores of money. Then… sit back & relax till next loose delivery is bowled no matter how many overs later.

We do not loose the wicket for not having played a ball or some overs at a stretch. Bowler keeps on bowling even when we don’t want to bat. Fine.. there are no stumps in BSE & NSE. The only way we get out is to play some bad shot and been ‘caught out’.

Some times we might have exercised inaction on some plump deliveries which should have been put away with ease in great style. That is ok.. we did not loose anything; it is only that we missed an earning opportunity. Having missed such a ball should not force us to go after the next delivery madly even if it is a yorker.

Very easy it is to play like Dravid. He is not expected to score runs of every delivery like Dhoni. Almost all mutual fund managers do not have that freedom to imitate Rahul, simply because they are compared with other player over after over, if not ball after ball. They are horses. Their fans and people bet on them always want these horses to perform tirelessly.

Hence there is no pressure from outside to be like Dravid for an individual investor like you and I. That does not let us be free from pressure, the pressure from inside. Not able to keep the money for some good investment opportunity might force to take any horse that came out first last hour. Yes.. pressure is purely internal and it is highly difficult to control emotions. Your girlfriend’s aunt made few thousand bucks in day trading does not have anything with you to trade. Even Harbajan can hit some ball to the fence. Does that mean that Dravid should imitate him?? Our worst enemy is nowhere but inside us.

It is equally bad to defend crazily easy deliveries. Do not even try for single or two, but got for the maximum, provide you know it is the ball that matches your line & length requirements. Some times full toss loose deliveries are for you to take. You are insane if you do not leverage (margin purchase or derivatives or whatever) with such investment opportunities. They occur once in a green-moon.

You may not know the delivery that could cost your wicket. That is not a problem. It is fair enough to know the delivery with which you can add up your score. Knowing what you know and playing the game according to your strengths is seldom practiced by investors. Are you one among them?

Any bad pitch in bad weather condition could yield you at least 5 deliveries to score in a 5 day test match. That is all what we need. Any bad economic condition in the worst of recession could provide you at least 5 investment options in a year. What else do we need?

Even for Dravid, sometimes it is not irrational to go for unconventional shots like reverse sweep. He might probably know there is no fielder and also probability of getting out is nil. Derivatives instruments are similar to that. They are to be played at the surest of the deliveries.

“Investors, please do not deal with derivatives and day trading each day. Know what? I don’t play reverse sweep at every delivery” says Dravid. Do we listen?

Thursday, May 18, 2006

From Warren's mouth

For those who are not aware of Warren Buffet, he is the second richest man in the world only after Mr.Gates. He is believed to be the greatest value investor of the 20th century. Story below talks about brokers, mutual funs manager, financial consultant etc who end up snatching our otherwise higher returns.

Happy reading!!

Happy reading!!

-Kuppusamy Chellamuthu

Cut your gains!

In his 2006 letter to Berkshire Hathaway shareholders, Warren Buffett explains how costly it can be to let advisors come between you and your money.

By Warren Buffett

Between Dec. 31, 1899, and Dec. 31, 1999, to give a really long-term example, the Dow rose from 66 to 11,497. (Guess what annual growth rate is required to produce this result; the surprising answer is at the end of this piece.)

This huge rise came about for a simple reason: Over the century, American businesses did extraordinarily well and investors rode the wave of their prosperity. Businesses continue to do well. But now shareholders, through a series of self-inflicted wounds, are in a major way cutting the returns they will realize from their investments.

The explanation of how this is happening begins with a fundamental truth: With unimportant exceptions, such as bankruptcies in which some of a company's losses are borne by creditors, the most that owners in aggregate can earn between now and Judgment Day is what their businesses in aggregate earn. True, by buying and selling that is clever or lucky, investor A may take more than his share of the pie at the expense of investor B.

And, yes, all investors feel richer when stocks soar. But an owner can exit only by having someone take his place. If one investor sells high, another must buy high. For owners as a whole, there is simply no magic -- no shower of money from outer space -- that will enable them to extract wealth from their companies beyond that created by the companies themselves.

Indeed, owners must earn less than their businesses earn because of "frictional" costs. And that's my point: These costs are now being incurred in amounts that will cause shareholders to earn far less than they historically have.

To understand how this toll has ballooned, imagine for a moment that all American corporations are, and always will be, owned by a single family. We'll call them the Gotrocks. After paying taxes on dividends, this family -- generation after generation -- becomes richer by the aggregate amount earned by its companies.

Today that amount is about $700 billion annually. Naturally, the family spends some of these dollars. But the portion it saves steadily compounds for its benefit. In the Gotrocks household everyone grows wealthier at the same pace, and all is harmonious.

But let's now assume that a few fast-talking Helpers approach the family and persuade each of its members to try to outsmart his relatives by buying certain of their holdings and selling them certain others. The Helpers -- for a fee, of course -- obligingly agree to handle these transactions. The Gotrocks still own all of corporate America; the trades just rearrange who owns what.

So the family's annual gain in wealth diminishes, equaling the earnings of American business minus commissions paid. The more that family members trade, the smaller their share of the pie and the larger the slice received by the Helpers. This fact is not lost upon these broker-Helpers: Activity is their friend, and in a wide variety of ways, they urge it on.

After a while, most of the family members realize that they are not doing so well at this new "beat my brother" game. Enter another set of Helpers. These newcomers explain to each member of the Gotrocks clan that by himself he'll never outsmart the rest of the family. The suggested cure: "Hire a manager -- yes, us -- and get the job done professionally."

These manager-Helpers continue to use the broker-Helpers to execute trades; the managers may even increase their activity so as to permit the brokers to prosper still more. Overall, a bigger slice of the pie now goes to the two classes of Helpers.

The family's disappointment grows. Each of its members is now employing professionals. Yet overall, the group's finances have taken a turn for the worse. The solution? More help, of course.

It arrives in the form of financial planners and institutional consultants, who weigh in to advise the Gotrocks on selecting manager-Helpers. The befuddled family welcomes this assistance. By now its members know they can pick neither the right stocks nor the right stock pickers. Why, one might ask, should they expect success in picking the right consultant? But this question does not occur to the Gotrocks, and the consultant-Helpers certainly don't suggest it to them.

The Gotrocks, now supporting three classes of expensive Helpers, find that their results get worse, and they sink into despair. But just as hope seems lost, a fourth group -- we'll call them the hyper-Helpers -- appears. These friendly folk explain to the Gotrocks that their unsatisfactory results are occurring because the existing Helpers -- brokers, managers, consultants -- are not sufficiently motivated and are simply going through the motions. "What," the new Helpers ask, "can you expect from such a bunch of zombies?"

The new arrivals offer a breathtakingly simple solution: Pay more money. Brimming with self-confidence, the hyper-Helpers assert that huge contingent payments -- in addition to stiff fixed fees -- are what each family member must fork over in order to really outmaneuver his relatives.

The more observant members of the family see that some of the hyper-Helpers are really just manager Helpers wearing new uniforms, bearing sewn-on sexy names like HEDGE FUND or PRIVATE EQUITY. The new Helpers, however, assure the Gotrocks that this change of clothing is all-important, bestowing on its wearers magical powers similar to those acquired by mild-mannered Clark Kent when he changed into his Superman costume. Calmed by this explanation, the family decides to pay up.

And that's where we are today: A record portion of the earnings that would go in their entirety to owners -- if they all just stayed in their rocking chairs -- is now going to a swelling army of Helpers. Particularly expensive is the recent pandemic of profit arrangements under which Helpers receive large portions of the winnings when they are smart or lucky, and leave family members with all the losses -- and large fixed fees to boot -- when the Helpers are dumb or unlucky (or occasionally crooked).

A sufficient number of arrangements like this -- heads, the Helper takes much of the winnings; tails, the Gotrocks lose and pay dearly for the privilege of doing so -- may make it more accurate to call the family the Hadrocks. Today, in fact, the family's frictional costs of all sorts may well amount to 20 percent of the earnings of American business. In other words, the burden of paying Helpers may cause American equity investors, overall, to earn only 80 percent or so of what they would earn if they just sat still and listened to no one.

Long ago, Sir Isaac Newton gave us three laws of motion, which were the work of genius. But Sir Isaac's talents didn't extend to investing: He lost a bundle in the South Sea Bubble, explaining later, "I can calculate the movement of the stars, but not the madness of men." If he had not been traumatized by this loss, Sir Isaac might well have gone on to discover the fourth law of motion: For investors as a whole, returns decrease as motion increases.

Here's the answer to the question posed at the beginning of this piece: To get very specific, the Dow increased from 65.73 to 11,497.12 in the 20th century, and that amounts to a gain of 5.3 percent compounded annually. (Investors would also have received dividends, of course.) To achieve an equal rate of gain in the 21st century, the Dow will have to rise by Dec. 31, 2099, to -- brace yourself -- precisely 2,011,011.23. But I'm willing to settle for 2,000,000; six years into this century, the Dow has gained not at all

Sunday, May 14, 2006

Diversification!! how much?

“Don’t put all your eggs in one basket”

Almost every one of us would have heard this famous dictum in the world of investment.

If one goes by the efficient market theory – a proven hypothesis, not that the hypothesis is proven to be true; but it is proven to be a hypothesis for ever – stock price of a company reflects current value of all the future earning expected from its operation from today till judgment day. (It is found on various occasions that market prices a security in anyway but efficient). In the short term, stock market could be driven by expectation and emotions of mass psychology. But in the long run it should – and would – reflect the true business strength and earning potential of the company.

You might say “hey stop. Where are we heading? What does this got to do with diversification & famous egg and basket story?” We do certainly not get out of track yet J

Well. As discussed above, the stock price is subject to fluctuation based on the performance of a company and its business. If some one chooses to put all his money in a business, then his destiny is likely to be determined by the prospects of that organization irrespective of weather he lies it or not. Having entered at a wrong price at a wrong time in a wrong business could be fatal. Companies like Bioncon and Jet airways have a bad year in the bourses albeit unprecedented rise in the benchmark index of Mumbai stock exchange. This happened albeit their market leader position in their respective industries. This is what happens when you put all your eggs in one basket. You drop the basket, eggs are gone. These are technically called unsystematic risks peculiar to a particular organization whereas systematic risk is for the entire country, it’s economy and stock market.

Diversification is a risk management technique that mixes a wide variety of investments within a portfolio. It strives to smooth out unsystematic risk events in a portfolio so that the positive performance of some investments will neutralize the negative performance of others. The rationale behind this technique contends that a portfolio of different kinds of investments will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio.

Even carefully selected stocks can plunge at times (like Pricol) irrespective of good business prospects. This is where diversification comes in handy. Having a couple of losers in a bag of 10 stocks is not a bad portfolio. You have sufficiently diversified. Sometimes inevitable negative effects of some losers are offset by the propelling positive effects of many winners.

But….there is nothing worse in the world like diversifying for the sake of it. I myself have done the mistake of not putting more than a fixed amount in a particular stock. Buying stocks worth same rupee value in each counter was my modus operandi. As of today my portfolio consists of 39 stocks and 4 mutual funds. This is excessive diversification for an individual investor of my size and risk profile. A little retrospect leads to an interesting figure. I have bought/sold/held 96 different companies in my portfolio in the past 2 years. Despite this high diversification, about 73 % of my total gain has resulted from top 10 stocks. All of them were sure winners; at least I believed so at the time of purchase. Nevertheless heavy allocation was not made to these stocks as I had a mental block of a rupee value beyond which I did not want to pump into one. The top 10 securities are below.

Zuari Industries

Era constructions

Alstom projects

Industrial Investment Trust

Tata steel

Century textiles

BHEL

Hindalco

ITC

SAIL

Avoiding excessive diversification – that I know for sure was done for the sake of diversifying – actually dragged down the performance of my entire portfolio. It is only my hard earned experience and an insight derived from voracious reading leading to the conclusion that ‘diversification is an excuse we want to generously grant ourselves for the lack of knowledge & depth in decision making abilities’. Some people buy some stocks and lot of mutual funds simply to comply the comfort of diversification. Ultimately mutual funds that he holds might end of holding same securities he holds himself. He is not diversified as he perceives (or even deceives) himself. As we discussed in the definition, diversifying is an act of avoiding business (unsystematic) risk and not the systematic risk that can crash the entire stock market. Holding 100 different securities does not guard you from systematic risk. Evens like war, political change, foreign policies can attribute to them. Similarly when the portfolio size grows, you try to simulate the market, thus leaving the chance of getting above the market returns (should I call beating the market?) limited. Diversification intended for neutralizing the bad effects of losers with the winners might ultimately dilute the portfolio where the performance of winners might get dragged down by losers and average performers.

I probably have not spent a enough time in the capital market to comment on ‘suit for all’ recipe in terms of diversification. From my personal experience and the amount of learning from reading great men’s view in this field, an ideal portfolio could not be more than 25 to 30. Widening your horizon leaves you at a position where you probably don’t know what to track and what not to track. Focus on your strengths and dive with full energy when you see some thing of your liking.

I do not fail to mention about Warren Buffett in my writings. As per his own statements, if you leave top 10 decisions he took, his results were nothing but ordinary. Warren’s phenomenal show was not a result of widening diversification; but a result of focus and concentration!!

Almost every one of us would have heard this famous dictum in the world of investment.

If one goes by the efficient market theory – a proven hypothesis, not that the hypothesis is proven to be true; but it is proven to be a hypothesis for ever – stock price of a company reflects current value of all the future earning expected from its operation from today till judgment day. (It is found on various occasions that market prices a security in anyway but efficient). In the short term, stock market could be driven by expectation and emotions of mass psychology. But in the long run it should – and would – reflect the true business strength and earning potential of the company.

You might say “hey stop. Where are we heading? What does this got to do with diversification & famous egg and basket story?” We do certainly not get out of track yet J

Well. As discussed above, the stock price is subject to fluctuation based on the performance of a company and its business. If some one chooses to put all his money in a business, then his destiny is likely to be determined by the prospects of that organization irrespective of weather he lies it or not. Having entered at a wrong price at a wrong time in a wrong business could be fatal. Companies like Bioncon and Jet airways have a bad year in the bourses albeit unprecedented rise in the benchmark index of Mumbai stock exchange. This happened albeit their market leader position in their respective industries. This is what happens when you put all your eggs in one basket. You drop the basket, eggs are gone. These are technically called unsystematic risks peculiar to a particular organization whereas systematic risk is for the entire country, it’s economy and stock market.

Diversification is a risk management technique that mixes a wide variety of investments within a portfolio. It strives to smooth out unsystematic risk events in a portfolio so that the positive performance of some investments will neutralize the negative performance of others. The rationale behind this technique contends that a portfolio of different kinds of investments will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio.

Even carefully selected stocks can plunge at times (like Pricol) irrespective of good business prospects. This is where diversification comes in handy. Having a couple of losers in a bag of 10 stocks is not a bad portfolio. You have sufficiently diversified. Sometimes inevitable negative effects of some losers are offset by the propelling positive effects of many winners.

But….there is nothing worse in the world like diversifying for the sake of it. I myself have done the mistake of not putting more than a fixed amount in a particular stock. Buying stocks worth same rupee value in each counter was my modus operandi. As of today my portfolio consists of 39 stocks and 4 mutual funds. This is excessive diversification for an individual investor of my size and risk profile. A little retrospect leads to an interesting figure. I have bought/sold/held 96 different companies in my portfolio in the past 2 years. Despite this high diversification, about 73 % of my total gain has resulted from top 10 stocks. All of them were sure winners; at least I believed so at the time of purchase. Nevertheless heavy allocation was not made to these stocks as I had a mental block of a rupee value beyond which I did not want to pump into one. The top 10 securities are below.

Zuari Industries

Era constructions

Alstom projects

Industrial Investment Trust

Tata steel

Century textiles

BHEL

Hindalco

ITC

SAIL

Avoiding excessive diversification – that I know for sure was done for the sake of diversifying – actually dragged down the performance of my entire portfolio. It is only my hard earned experience and an insight derived from voracious reading leading to the conclusion that ‘diversification is an excuse we want to generously grant ourselves for the lack of knowledge & depth in decision making abilities’. Some people buy some stocks and lot of mutual funds simply to comply the comfort of diversification. Ultimately mutual funds that he holds might end of holding same securities he holds himself. He is not diversified as he perceives (or even deceives) himself. As we discussed in the definition, diversifying is an act of avoiding business (unsystematic) risk and not the systematic risk that can crash the entire stock market. Holding 100 different securities does not guard you from systematic risk. Evens like war, political change, foreign policies can attribute to them. Similarly when the portfolio size grows, you try to simulate the market, thus leaving the chance of getting above the market returns (should I call beating the market?) limited. Diversification intended for neutralizing the bad effects of losers with the winners might ultimately dilute the portfolio where the performance of winners might get dragged down by losers and average performers.

I probably have not spent a enough time in the capital market to comment on ‘suit for all’ recipe in terms of diversification. From my personal experience and the amount of learning from reading great men’s view in this field, an ideal portfolio could not be more than 25 to 30. Widening your horizon leaves you at a position where you probably don’t know what to track and what not to track. Focus on your strengths and dive with full energy when you see some thing of your liking.

I do not fail to mention about Warren Buffett in my writings. As per his own statements, if you leave top 10 decisions he took, his results were nothing but ordinary. Warren’s phenomenal show was not a result of widening diversification; but a result of focus and concentration!!

Tuesday, May 02, 2006

Mutual Funds in Bull market

by Kuppusamy Clellamuthu

Mutual funds have done a commendable job hitherto in India & elsewhere in the world. They have brought in millions of investors into equity investing, thought indirectly. That is some efforts laudable.

However many of us have a belief that mutual funds would grow at the rate of 40-45% every year (some people say 20-25 % YOY growth is not a concern with mutual funds). It does not make any sense to expect every year to be the same way how the last 2-3 years have been. Mutual funds have generated returns in the range of -30% (or even lesser) during the bear market of 2001-02.

Hell lot of money has been collected since the beginning of this calendar year where the market never looked attractive. In an extended bull markets like this one, people see the enormous returns generated by the mutual funds in the recent past and pump in money (purchase/invest in MF). Heavy inflow obtained this way leaves fund managers with few choices (all of them being bad) at these high levels. They have no choice but to put them in the same stocks they already own even at higher levels. Some funds need to keep some (more) money away for rainy days at these levels. This reduces the return for people invested later. Inevitably markets tend to correct/crash at some stage later. Seeing a fall in market & their NAVs people tend to withdraw their money from the funds. Fund managers are forced to sell more stocks at these low levels to meet these needs, thus driving the prices even lower. No one is ready to keep their money or put in new level where there are attractive buy opportunities for the fund.

In the last 1990’s and in 2000 lot (some one should find a better & bigger word at this place) of investor put in to .com/technology funds in US. They did not bother even with companies trading at 500-1000 times of their earnings. After historic correction (companies lost from 50-80 % of their value from late 2000 till 2002) in 2002, nearly half the investors were ready to invest in shares and MF. More and more attractive picks were present at that time. After all rational behavior and human nature never go together.

Mutual funds have done a commendable job hitherto in India & elsewhere in the world. They have brought in millions of investors into equity investing, thought indirectly. That is some efforts laudable.

However many of us have a belief that mutual funds would grow at the rate of 40-45% every year (some people say 20-25 % YOY growth is not a concern with mutual funds). It does not make any sense to expect every year to be the same way how the last 2-3 years have been. Mutual funds have generated returns in the range of -30% (or even lesser) during the bear market of 2001-02.

Hell lot of money has been collected since the beginning of this calendar year where the market never looked attractive. In an extended bull markets like this one, people see the enormous returns generated by the mutual funds in the recent past and pump in money (purchase/invest in MF). Heavy inflow obtained this way leaves fund managers with few choices (all of them being bad) at these high levels. They have no choice but to put them in the same stocks they already own even at higher levels. Some funds need to keep some (more) money away for rainy days at these levels. This reduces the return for people invested later. Inevitably markets tend to correct/crash at some stage later. Seeing a fall in market & their NAVs people tend to withdraw their money from the funds. Fund managers are forced to sell more stocks at these low levels to meet these needs, thus driving the prices even lower. No one is ready to keep their money or put in new level where there are attractive buy opportunities for the fund.

In the last 1990’s and in 2000 lot (some one should find a better & bigger word at this place) of investor put in to .com/technology funds in US. They did not bother even with companies trading at 500-1000 times of their earnings. After historic correction (companies lost from 50-80 % of their value from late 2000 till 2002) in 2002, nearly half the investors were ready to invest in shares and MF. More and more attractive picks were present at that time. After all rational behavior and human nature never go together.

Monday, May 01, 2006

IPO Scam

by Kuppusamy Chellamuthu

During my high school days, we had gober gas facility for our farm house. That more than sufficed cooking gas needs of our family. We never really needed kerosene that we could get at subsidized rate with our ration card. There were many other such farmer families in our hamlet. Kerosene quota of these families was used by others who did not have this bio gas setup for themselves. The needy would borrows ration cards and utilize the provision available on the cards. This is not a bigger sin as long as it is used for family!! How about a big provisional store owner fabricating multiple ration cards with various names (with the help of greedy card issuing authorities) to obtain goods at damn cheap rate and consequently sell thee same with high margin on the same day or in a week?? This kind of act is not only unfair but also unforgivable. You are misusing the quota that is meant for needy people.

Recently heard Initial Public Offer (IPO) scams are not too different. In every IPO, retail investors get 35% quota of the issue size. If the issue size of say Rs1000 cores, Rs350 crores are to be offered to the retail investors. A retail investor by definition can apply for maximum of Rs.1 lakh. If some one who is rich wants to apply to the tune of Rs 50 lakhs, he would come under non institutional investor category. Quota for this section is roughly one third of retail section and also the demand (from such wealthy people) would be high. The chances of getting allotment owing to oversubscription are very minimal. On the other hand if he could find 50 retail investors who don’t apply for this particular IPO? He cold pretty well (like the ration card borrowing example) requests his 50 friends to apply Rs 1 lakh each on their account on his behalf. This way his chances of getting more shares are enhanced. Is it not a pain to go after 50 worthless people for this high network individual for the sake of an IPO? Answer might be a probable YES. What about opening 50 bogus demat account with fake names?? If the officials involved – like out ration card issuing authorities – help in opening such multiple accounts, his mission is accomplished.

For any one to have a demat account, there should be a savings bank account attached to it. For people who open trading accounts in ICICI, you get saving bank a/c, demat a/c and trading account in one go with one company. Unlike ICICI, many brokers who only operate demat and trading accounts don’t have banking business on their own (example Karvy). Even if Karvy aggress to open multiple bogus accounts for you, it is imperative to have multiple banking accounts with some bank. You need to know some one at such banks who can open accounts on non-existing people’s names. Banks need photo, names, signature, etc to have an account with them.

A lady Rupal Panchal and her associates commenced a photo shop and offered free photos as part of their promotional (???) initiatives. Rushed with such an offers people took free photos from the mentioned studio. Studio successfully mobbed thousands of faces for them to use. With photos collected this way, they opened saving accounts with various banks and demat accounts primarily with Karvy, a Hyderabad based stock broking firm. From a single address she was able to have more than 5000 demat accounts. She massively applied from all these accounts to the YES bank and IDFC IPO, transferred allotted shares to a single account a day before listing & massive sell on the first day of listing. Set ready for next IPO……

After many investigations SEBI came out on 29-April-2006 heavily on Karvy, India bulls and some other brokers. Look at a report:

“ Some of the demat accounts that were used to manipulate allotments in the initial public offer of Yes Bank and IDFC were opened during 2003, and not in the last year as was earlier believed. The first IPO in which the key operators have participated was that of Maruti Udyog Ltd, in June 2003, though the number of fictitious demat accounts were not very high then, the interim order from Securities and Exchange Board of India has said.”

This could have been avoided if the IPO lead manager had checked all applications with the same address (may be more than 6 or 7 as various members of the same family can apply for same IPO). The banks and brokers clearly violated KYC (know your customer) norms before opening such accounts. It often takes a scam to tighten the rules – leave alone reform - to create a fair system for common retail investors. Even ICICI bank opened few such accounts and it was let go free with a fine of Rs 5 lakhs. How fair??? Nonetheless the SEBI order is most solicited; though late, it did occur.

If you find some delays in opening a new account due to reasons like first name & last name mismatch, address mismatch, sign improper, PAN card not present etc, you are not alone. Another rule is in place to block off market transfer before the day of listing. These should be in the best interest of none but people like us.

In the coming days, we have no choice but to believe that (# of times) oversubscription legitimate. It better be!!!!

During my high school days, we had gober gas facility for our farm house. That more than sufficed cooking gas needs of our family. We never really needed kerosene that we could get at subsidized rate with our ration card. There were many other such farmer families in our hamlet. Kerosene quota of these families was used by others who did not have this bio gas setup for themselves. The needy would borrows ration cards and utilize the provision available on the cards. This is not a bigger sin as long as it is used for family!! How about a big provisional store owner fabricating multiple ration cards with various names (with the help of greedy card issuing authorities) to obtain goods at damn cheap rate and consequently sell thee same with high margin on the same day or in a week?? This kind of act is not only unfair but also unforgivable. You are misusing the quota that is meant for needy people.

Recently heard Initial Public Offer (IPO) scams are not too different. In every IPO, retail investors get 35% quota of the issue size. If the issue size of say Rs1000 cores, Rs350 crores are to be offered to the retail investors. A retail investor by definition can apply for maximum of Rs.1 lakh. If some one who is rich wants to apply to the tune of Rs 50 lakhs, he would come under non institutional investor category. Quota for this section is roughly one third of retail section and also the demand (from such wealthy people) would be high. The chances of getting allotment owing to oversubscription are very minimal. On the other hand if he could find 50 retail investors who don’t apply for this particular IPO? He cold pretty well (like the ration card borrowing example) requests his 50 friends to apply Rs 1 lakh each on their account on his behalf. This way his chances of getting more shares are enhanced. Is it not a pain to go after 50 worthless people for this high network individual for the sake of an IPO? Answer might be a probable YES. What about opening 50 bogus demat account with fake names?? If the officials involved – like out ration card issuing authorities – help in opening such multiple accounts, his mission is accomplished.

For any one to have a demat account, there should be a savings bank account attached to it. For people who open trading accounts in ICICI, you get saving bank a/c, demat a/c and trading account in one go with one company. Unlike ICICI, many brokers who only operate demat and trading accounts don’t have banking business on their own (example Karvy). Even if Karvy aggress to open multiple bogus accounts for you, it is imperative to have multiple banking accounts with some bank. You need to know some one at such banks who can open accounts on non-existing people’s names. Banks need photo, names, signature, etc to have an account with them.

A lady Rupal Panchal and her associates commenced a photo shop and offered free photos as part of their promotional (???) initiatives. Rushed with such an offers people took free photos from the mentioned studio. Studio successfully mobbed thousands of faces for them to use. With photos collected this way, they opened saving accounts with various banks and demat accounts primarily with Karvy, a Hyderabad based stock broking firm. From a single address she was able to have more than 5000 demat accounts. She massively applied from all these accounts to the YES bank and IDFC IPO, transferred allotted shares to a single account a day before listing & massive sell on the first day of listing. Set ready for next IPO……

After many investigations SEBI came out on 29-April-2006 heavily on Karvy, India bulls and some other brokers. Look at a report:

“ Some of the demat accounts that were used to manipulate allotments in the initial public offer of Yes Bank and IDFC were opened during 2003, and not in the last year as was earlier believed. The first IPO in which the key operators have participated was that of Maruti Udyog Ltd, in June 2003, though the number of fictitious demat accounts were not very high then, the interim order from Securities and Exchange Board of India has said.”

This could have been avoided if the IPO lead manager had checked all applications with the same address (may be more than 6 or 7 as various members of the same family can apply for same IPO). The banks and brokers clearly violated KYC (know your customer) norms before opening such accounts. It often takes a scam to tighten the rules – leave alone reform - to create a fair system for common retail investors. Even ICICI bank opened few such accounts and it was let go free with a fine of Rs 5 lakhs. How fair??? Nonetheless the SEBI order is most solicited; though late, it did occur.

If you find some delays in opening a new account due to reasons like first name & last name mismatch, address mismatch, sign improper, PAN card not present etc, you are not alone. Another rule is in place to block off market transfer before the day of listing. These should be in the best interest of none but people like us.

In the coming days, we have no choice but to believe that (# of times) oversubscription legitimate. It better be!!!!

Saturday, April 29, 2006

Stock Valuation

- by Kuppusamy Chellamuthu

The topic discussed below might be too trivial to some. But still as many in this group are getting the flavor of equities for the first time, it might make more sense.

Have you been amused by statements like

* Indian market over valued

* Prices have already discounted 2008 earnings

* 16.5x of FY06 earnings

* Shares trades at 8 times of earnings which is below its peers

* Indian stocks are fairly valued when compared to other emerging markets

What does this damn things valuation mean? Let us discuss it with an example below.

What is EPS:

First and fundamental thing to understand is EPS (Earnings per Shares). This means the money one share (which is a part of the ownership) earns in that year/quarter. If there is a total of 1000 equity shares and the company’s profit for the year is Rs 10,000, each individual share earned Rs.10. This is what is known as EPS by dividing the profit by total number of shares.

What is PE ratio:

PE ratio is price earning ratio which is the ratio of market price of the share to the earning of the shares. In the above example we calculated the earning of a share (EPS) as Rs.10. Let us assume that this share trades at Rs.120 in the market. PE ratio is calculated as Price/EPS = 120/10 = 12. This company trades at an PE of 12 or 12 times of its earnings.

What can one infer from this? Well.. you need to pay a price of Rs. 120 to earn a profit of Rs.10 at the end of the year. Is it costly or attractive? Purely depends on the risk appetite of the investor. This turns out to be 8.33 % earning in an year (10/120) * 100. Anyone is OK for such a gain/return in a year could buy at this level. As a matter of fact a low PE value is good and higher PE is certainly expensive. When there are two companies that operate in the same market with same efficiency (say Infy & Wipro) it is good to buy the company that have the lowest PE , given all other variables remain same.

Does that mean that a higher PE is not to be bought at all? Then why the heck some companies are trading at 40 times to 100 times of their earnings. Well.. the market expect these companies perform exceptionally well. A share price of Rs.200 for EPS of Rs 4 translates to a PE of 50. Is one simply looks at the yield it is just 2 %. However if the earnings double for the next 2 years, its EPS would Rs 16 after 2 years. So the current price of 200 is 12.5 times of n+2 yrs (say year 2008 yearnings). This looks OK. But one needs to be sure about the growth like how Infosys, Bharati tele etc have grown.

Being equipped with these terminologies helps one understand (al least an attempt to understand) and analyze recommendation and so called hot tips from your broker. Mind you.. brokers feel ease to work with clients who asks no questions; but pay little respect. After all for him it is money for every trade no matter you gain or loose.

Have a nice day!!

Friday, April 28, 2006

Setting Realistic Expectations

A friend of mine called this afternoon to convey the vacancy he came across in his company which he thought might suit me. We talked about few other things as well. He has been an investor through equity mutual funds for the past 1 year. Most of his funds have appreciated more than 100 % and his net investment as per NAV is around Rs 2 lakhs. He sounded pretty optimistic to make it to Rs 5 million (half crore) in the next 5 years.

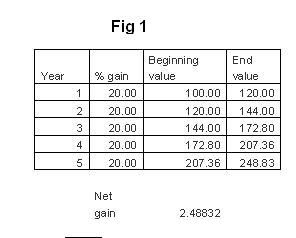

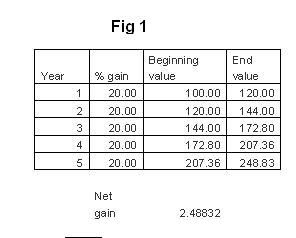

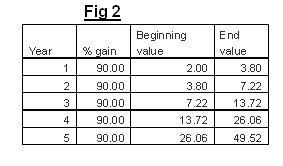

With a very optimistic gain of 20% a year, Rs.100 invested now would becomes Rs. 248 at the end of 5 years. (refer first table)

This is just around 2.5 times. With this formula, his current investment of 2 lakhs would turn somewhere near 5 lakhs. Not 50 lakhs!!!

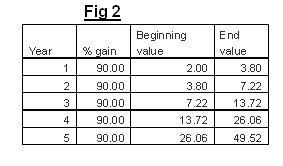

Now we’ll see how much CAGR (compounded annual growth rate) is required to turn his Rs.2 lakhs into half crore. (refer second table)

A consistent 90% gain every year without fail is mandated to achieve this ambitious destination.

No one of us have any doubt on the performance share market from 2003 onwards. It has been exemplary by any standards. But, can we expect this to repeat every year?

Let me draw a simple parallel from game of cricket to illustrate this fact. I have a friend who is a great soccer player himself and a great fan of the game. He hardly watched any cricket during his life till now. This year some of us were watching an one day cricket match. It was the initial 15 overs of the game and Shewag scored 4 consecutive 4 run shots with ease (some thing we have been watching with the market in the last 3 years). Power cut!!! People started anxious to know the progress of the match & the score India can get at the end of 50 overs. We also started making small bets to pass time on the likely to be score. Our man calculated remaining 40 overs (with the same rate Shewag scored in the last 4 deliveries) and believed India could get 960 more runs (40 overs * 6 balls * 4 runs) at the end of the innings. Total asinine!!

To arrive at a score one should know

* how many wickets remain

* which bowlers line up in the opposition team

* nature of the pitch

* pressure level in the game etc etc..